FAMR Adviser Home Report –Man v Machine Mk11

Extract 1 – How do advisers target clients?

It’s said that since RDR advisers only deal with higher net worth clients – as part of our FAMR related adviser research we needed to test this assumption. Here’s our summary findings on this from research covering 120 individual advisers.

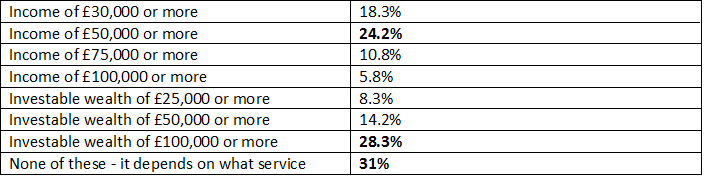

What determines client profitability – in terms of their income or wealth? Profit Tipping Points

Adviser comments on economics driven client targeting

- We estimate we need to earn £1500 p.a. to break-even on a full service face to face advice case

- I would like to make £1000 per case, with expenses and tax that equates to a net £500

- I retain low net worth clients but some of them now cost me to service and I am beginning to turn away new clients who have less than £100k

- Minimum earning requirement over a 12 month period is £500 otherwise not viable. That is for our lowest service level

- I need at least £500-£750 to complete a review and provide advice. These ex clients are now in the advice wilderness and generally speaking only the middle class and wealthy have any access to quality financial advice

- Minimum net wealth (investable assets) of £250,000 or more

- At retirement £50,000 but consideration given to relationships with family, or employer, to adviser firm

- With all the compliance, regulation and management and review procedures it is difficult to offer our services to anyone with less than £50,000.

- The majority of our clients have relatively low incomes but significant investable wealth - average amount invested is coming close to £500k

- Investable wealth of £25,000 will only generate £125 per year in on- going advice at 0.5% and that won’t warrant a full annual review, maybe an email review would work

- One of our clients on £25,000 a year and with no assets aside from his house just received £750,000 from a critical Illness policy we arranged, and we are now investing this money

Comments indicating a more rounded approach to client targeting

- We look both at current levels but also future prospects & family

- A degree of cross-subsidy within the firm helps to ensure that less well-off clients receive the appropriate service they need to achieve their goals

- Referrals - possibly the most important aspect of our business and that of thousands of adviser firms. If a client with an income of less than £30,000 and less than £25,000 of investable wealth provides 3 good-quality personal recommendations, then an unprofitable client becomes very profitable overnight!

- The profitability of a client should not be measured by investable assets; holistic advice includes strategic aspects outside of the investment arena -so the total amount of investable assets can be irrelevant

- All clients can be profitable; it’s just a matter of scale to meet client demand. A not so valuable client today can be tomorrow’s valuable client or can be related to one. EVERY client is Valuable

- We can earn money from low value clients even if only as a contribution to fixed costs. I have always taken the view that the low value client may introduce to higher value referrals

- It is still possible to make profit from less affluent clients if costs can be kept manageable

- A mortgage and some protection could easily be profitable with low income and capital to invest

- There are many advisers that deal with lower wealth clients, you can see their income/wealth is irrelevant. There is a place for both the small transactional adviser and the HNW wealth maintenance adviser

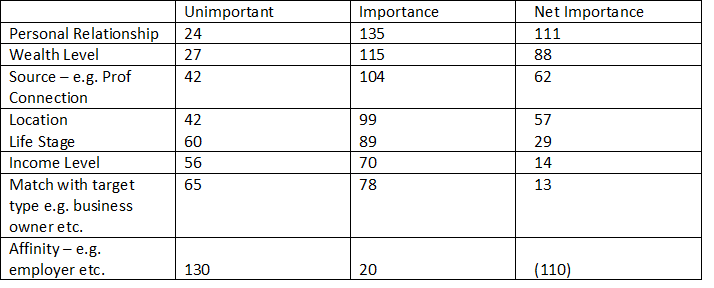

What factors determine the clients advisers deal with?

Note: respondents were asked to rate these factors as Important, Very Important, Unimportant and Very Unimportant – the figures below have been weighted such that a “Very” response is given a double weighting. As we would expect – Personal Relationship is the strongest factor.

Do you agree? Please share your views below>>